Werner & Mertz signs private Power Purchase Agreement

Contractual construct is a pioneering achievement in the energy industry

Werner & Mertz strives to make all areas of business as sustainable as possible. That applies to the power supply too. For decades the company has used green electricity exclusively and has long searched for a wind farm operator that can supply it with power direct from renewable sources. Recently the company signed a private Power Purchase Agreement (PPA) which brings ecological and ecnomic advantages in equal measure. Two wind turbines in the wind farm operated by SelzEnergie in Selzen, Rhineland-Palatinate, generate direct electricity for the medium-sized enterprise in Mainz, resulting in cost savings of 22 percent compared to conventional green electricity offerings for the same amount of power.

“A PPA not only pays off financially, but also adds to the credibility of the company. That’s an aspect that should not be economically underestimated in the long term,” says Werner & Mertz owner Reinhard Schneider.

“Of course we wanted to seize the chance to supply wind energy to Werner und Mertz GmbH, a pioneer in ecological production in Germany. We thus play a part in the entire process in the premier class and that’s exactly where we want to go with our electricity,” says Gelhausen, one of the founders of SelzEnergie.

The Contract Structure

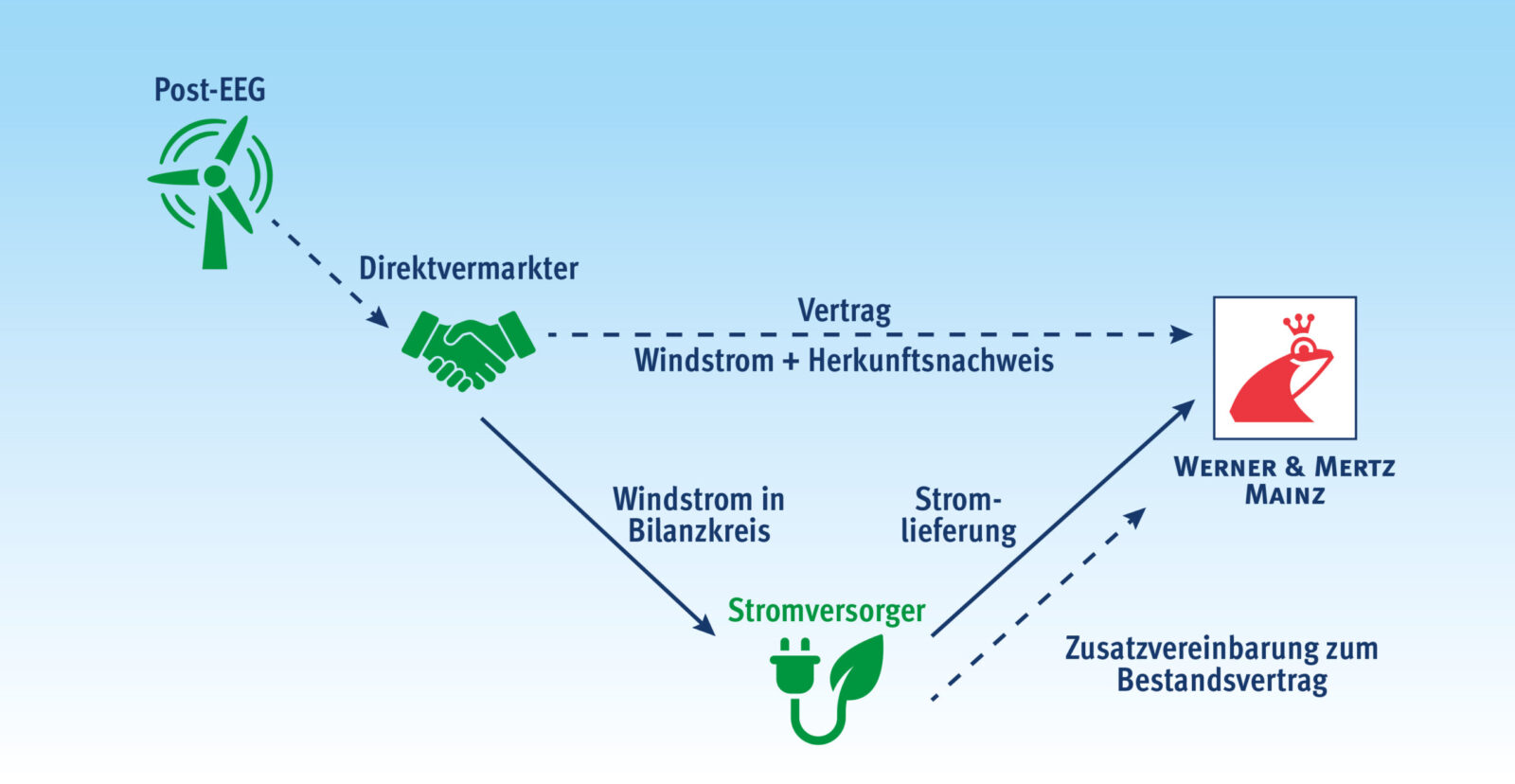

A PPA is a special power supply contract that directly binds the corporation and the system operator. In this case, SelzEnergie GmbH makes two of its wind turbines available to Werner & Mertz for direct production of electricity. Two other partners besides the wind farm operator are the energy supplier with whom a supplementary agreement to the main contract is made and a direct marketer who serves as the link between the farm operator, the electricity supplier and the (corporate) buyer. The electricity supplier obtains the wind power volumes from the direct marketer and takes them into its grid at no extra charge. For this additional service, Werner & Mertz pays a modest fee to the electricity supplier. The direct marketer pays the wind farm operator SelzEnergie for the generation of the electricity and Werner & Mertz pays the direct marketer for the purchase of the electricity, its technical management and assumption of risk. The direct marketer thus represents a type of insurance for the corporation. Its meteorologists make daily forecasts of the quantities that actually flow from the wind turbines in Selzen into the balancing group; those quantities are then financially assigned to the electricity supplier. To ensure that the Mainz family company is not without electricity at windless times, a fallback level is set up. When the wind turbines deliver less electricity than planned, the corporate customer pays only for what was forecast. The direct marketer offsets the shortfall from its own wind farm portfolio so that Werner & Mertz always gets the same electricity volumes, including in windless periods. This procedure is referred to as “balancing energy debt”. Conversely, the direct marketer retains the surplus when winds are strong.

“The jointly developed contractual construct is a genuine pioneering achievement because it is the first of its kind in the energy business. We managed to implement the idea over the course of many meetings involving more than 30 participants from five organizations,” says Energy Manager Simon Gübler.

Advantages of PPAs over standard green electricity contracts

In contrast to a conventional green electricity contract with an electricity supplier, a PPA offers the following advantages:

1. Werner & Mertz knows exactly where the electricity comes from and, with its specific demands, supports the regional expansion of electricity generation from renewable sources. That stands in contrast to conventional eco power contracts in which mass-balance is calulated and the electricity is purchased from the anonymous global energy mix. With conventional eco power contracts, it is difficult to find out where the electricity comes from. It’s certain that the smallest share is generated regionally, with the largest portion obtained from Iceland, Sweden or Norway. Documenting the business with guarantees of origin, however, is more like trading in carbon offsetting certificates. According to scientific assessments, a long-term load-adjusted PPA is preferable to a conventional eco power contract as the PPA can be offset with significantly lower CO2 emissions and because the system offers greater transparency.

2. Faced with the elimination of EEG funding (Erneuerbare-Energien-Gesetz or Germany’s renewable energy law) for wind turbines after 20 years, electricity suppliers are offering their renewable electricity at notably lower prices than conventional green electricity providers.

Currently, these PPAs pay off for medium-sized enterprises because the EEG funding is expiring gradually for many wind turbines. The operators, which are dependent on the daily price in the spot market, have to maintain their position in the market. That’s why a PPA is advantageous to both sides. The operators again have financial security and their farms remain profitable. The corporate buyers acquire renewable electricity at favorable terms and conditions.

3. The amount of wind power generated equals the corporate buyer’s consumption. With the PPA model from Werner & Mertz, a reliable load profile balancing can be carried out with all stakeholders in the contract. That means that every 15 minutes the electricity produced is compared to the needs of the corporation. In total 35,400 comparisons are made in a year, making precise invoicing possible.

“The labor-intensive development of this pioneering PPA construct was just the beginning for us. Together with our partners we will continue researching innovative approaches and solutions for the future in order to provide our site with electricity from verifiable and transparent renewable energy sources and thus strengthen and promote regional generation of renewable energy,” said Yannic von Raesfeld, Head of Sustainability Management at Werner & Mertz.